Let me introduce you to Nicole Lapin, a finance expert you don’t need a dictionary to understand. She was the youngest anchor ever at CNN and CNBC, while frequently contributing financial reports to MSNBC and the Today show. Nicole has also served as a business anchor and special correspondent for Bloomsberg Television. She’s the money-saving correspondent for The Wendy Williams Show and reports on Hollywood business for The Insider. Nicole has earned the Accredited Investment Fiduciary (AIF) certification, and graduated as the valedictorian of her class at Northwestern University’s Medill School of Journalism.

Pretty damn impressive, right?

This past winter, she launched her book Rich Bitch, a Simple 12-Step Plan for Getting Your Financial Life Together… Finally. Nicole was kind enough to send me a copy of Rich Bitch to review here on the blog. I can’t wait to share my thoughts!

About the Book

(From the inside cover) In Rich Bitch, money expert and financial journalist Nicole Lapin lays out a 12-step plan in which she shares her experiences – mistakes and all – of getting her own finances in order. She talks to you not like a lecturer but as your friend. And even though money is typically an “off limits” conversation, nothing is off-limits here.

Rich Bitch rehabs whatever bad money habits you might have and provides a plan you can not only sustain, but also thrive on. You won’t feel deprived but rather inspired to go after the rich life you deserve, and confident enough to call yourself a Rich Bitch.

My 3 Favorite Rich Bitch Steps

I’m not going to share with you all 12 of Nicole’s steps to becoming a Rich Bitch, but I will go through three of my favorites.

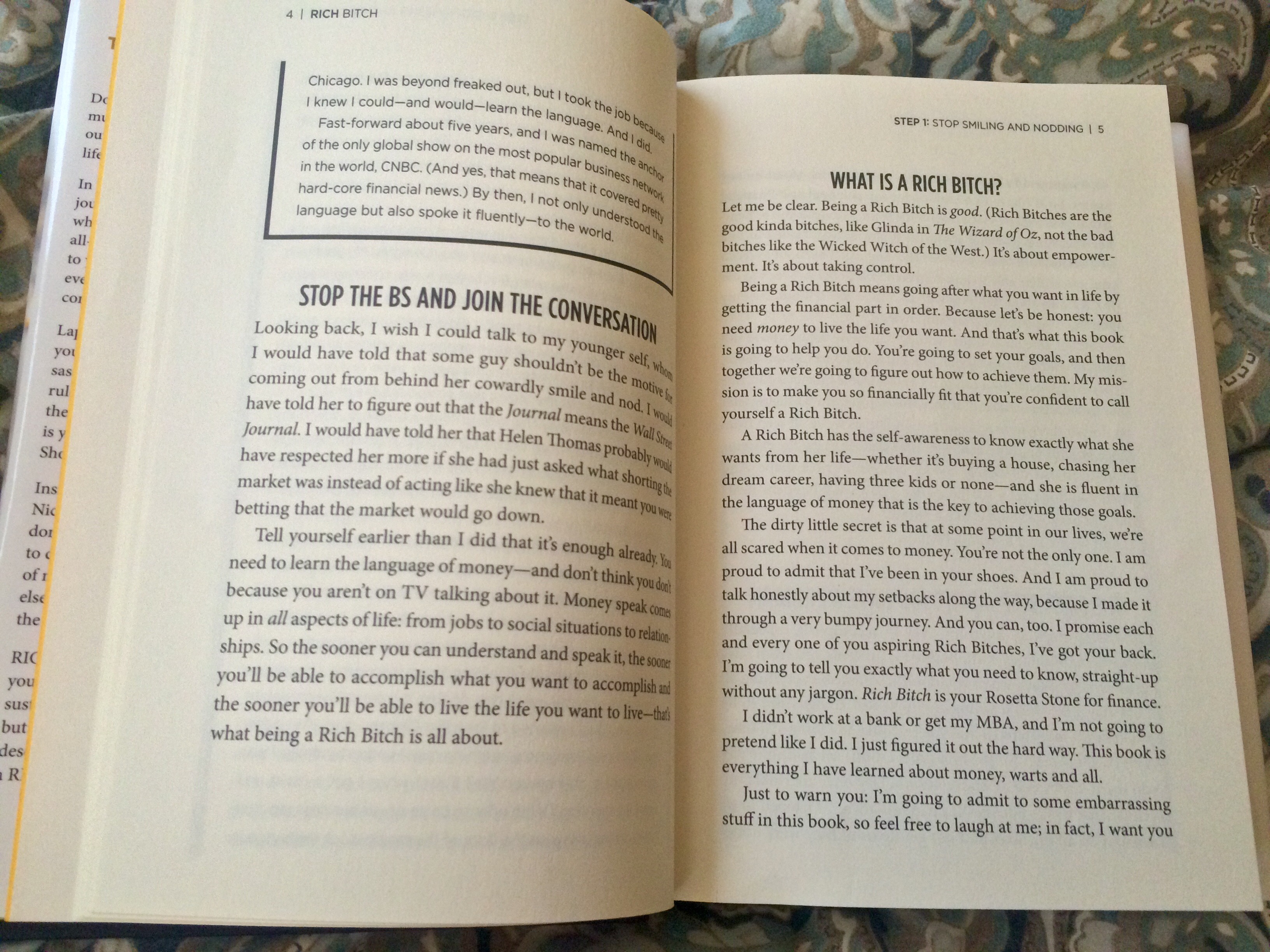

1. Stop Smiling and Nodding – Embrace the Rich Bitch Attitude

In this chapter, Nicole tells us to learn the language of money. Money speak comes up in all aspects of life, from social and business situations to personal relationships. The sooner you learn the language of money, the sooner you’ll be able to accomplish what you want financially and the sooner you’ll be able to join in on important conversations.

2. Eat Pray Drive – Transportation, Food, Insurance & Other Essential Expenses

In chapter five, Nicole talks about how you should tackle the essential expenses in your life, such as food and transportation. My favorite tip from this section is to always negotiate you bills, including your cable bill. You should always ask for a better rate. The worst thing they could do is say no. Many times, providers will give you a discount or current promotion instead of losing you as a customer.

Nicole also addresses why she’s not a huge fan of autopay. She shared an experience she had when she signed up for automatic payments for her TV service. The provider offered a special football package free for the first few weeks, but after that an additional $35 was tacked onto her bill. Once she realized this was going on, she called the company to cancel. Unfortunately, she missed the opt-out deadline and was stuck with the extra charge until the Super Bowl. She learned a valuable lesson: just because you choose autopay doesn’t mean you should stop reading your bills.

3. Get that Money Off Your Back – Paying Down Debt

Nicole mentions a few myths when it comes to debt. Number one: Debt is good to build credit. FALSE. Building up credit history so you can get a low rate on a mortgage or other loan is good. Owing money just for the sake of owing money or because you want a shiny new toy is not smart. Number two: You can’t negotiate your credit card rate. FALSE. It can’t hurt to ask. If your rate is higher than average, call the credit card company and ask for your rate to be lowered.

Nicole also has a whole section of this chapter dedicated just to student loans. Student loans are technically considered “good debt” because you’ve invested in yourself, which in theory will provide you with the tools needed to pay the debt off many times over. If you’re thinking about consolidating your loans, be sure to remember that timing is everything.

According to Nicole, “Wait until you’ve graduated before consolidating your student loans, but don’t wait too long. Typically, you get a six-month grace period when you graduate before you have to start repaying your student loans. That’s where the sweet spot is: you can get a lower interest rate for repayment if you consolidate during the grace period. If overall interest rates are high during your grace period, it might be better to jump into paying right off the bat and then wait for rates to come down before considering consolidation.

Final Thoughts

I really enjoyed this book. I read it this summer while hanging out at the pool. It’s not hard to understand at all, and Nicole gives you everything you need to get your finances in order. It’s not a “get rich quick” book by any means. So if that’s what you’re looking for, this isn’t for you. However, if you’re searching for a guide book on how to get financial peace of mind, you NEED to get this book. I highly recommend this book for anyone currently in debt, right out of college, or really anyone who wants to get more involved in saving for the future. You can purchase Rich Bitch for just $12.57 on Amazon right now.

Thank you for reading my post!

Don’t forget to follow me on: Pinterest | Instagram | Facebook | Twitter